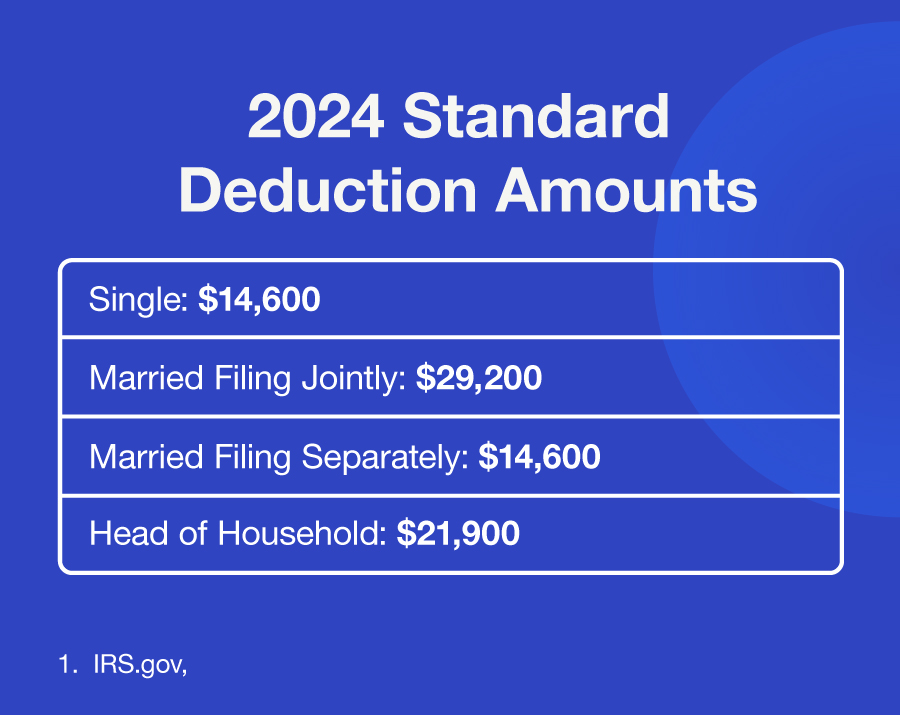

Standard Deduction 2025 Married Separately. $14,600 for married couples filing separately; Here are the standard deduction amounts set by the irs:

For 2025, that extra standard deduction is $1,950 if you are single or file as head of household. Taxpayers who must itemize deductions include:

2025 Standard Deduction Over 65 Married Joint Karin Marlene, Single or married filing separately (mfs) $14,600.

Irs 2025 Standard Deduction For Seniors Over 65 Bobbi Kevina, For 2025 returns filed in 2025, the standard deduction for those married filing separately is $13,850, whereas the standard deduction for joint returns is double:

Standard Tax Deduction 2025 Married Jointly Over 65 Edith Gwenore, The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed.

What’s My 2025 Tax Bracket? Wisconsin Benefit Planning, Married filing joint (mfj) or surviving spouse $29,200.

2025 Standard Tax Deduction Married Jointly Under 80c Katee Matilde, The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an increase of $750 from 2025.

2025 Standard Deduction Head Of Household Married Filing Jointly, The 2025 standard deduction amounts are as follows:

Standard Deduction 2025 Married Jointly 65 Years Old Elfie Helaina, These amounts are up from $13,850 and $27,700, respectively, for 2025.