New Tax Regime Fy 2025-24. Let's understand income tax calculation under the current tax slabs and new tax slabs. The basic exemption limit hiked to rs 3 lakh from rs 2.5 lakh under the new.

The income tax slab for fy 2025 under either the new or old tax system is an option for super senior people, just as for other individual taxpayers. Singapore follows a progressive tax rate, which means that the more chargeable income is declared the more taxes are payable to the local tax authority.

To achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2025.

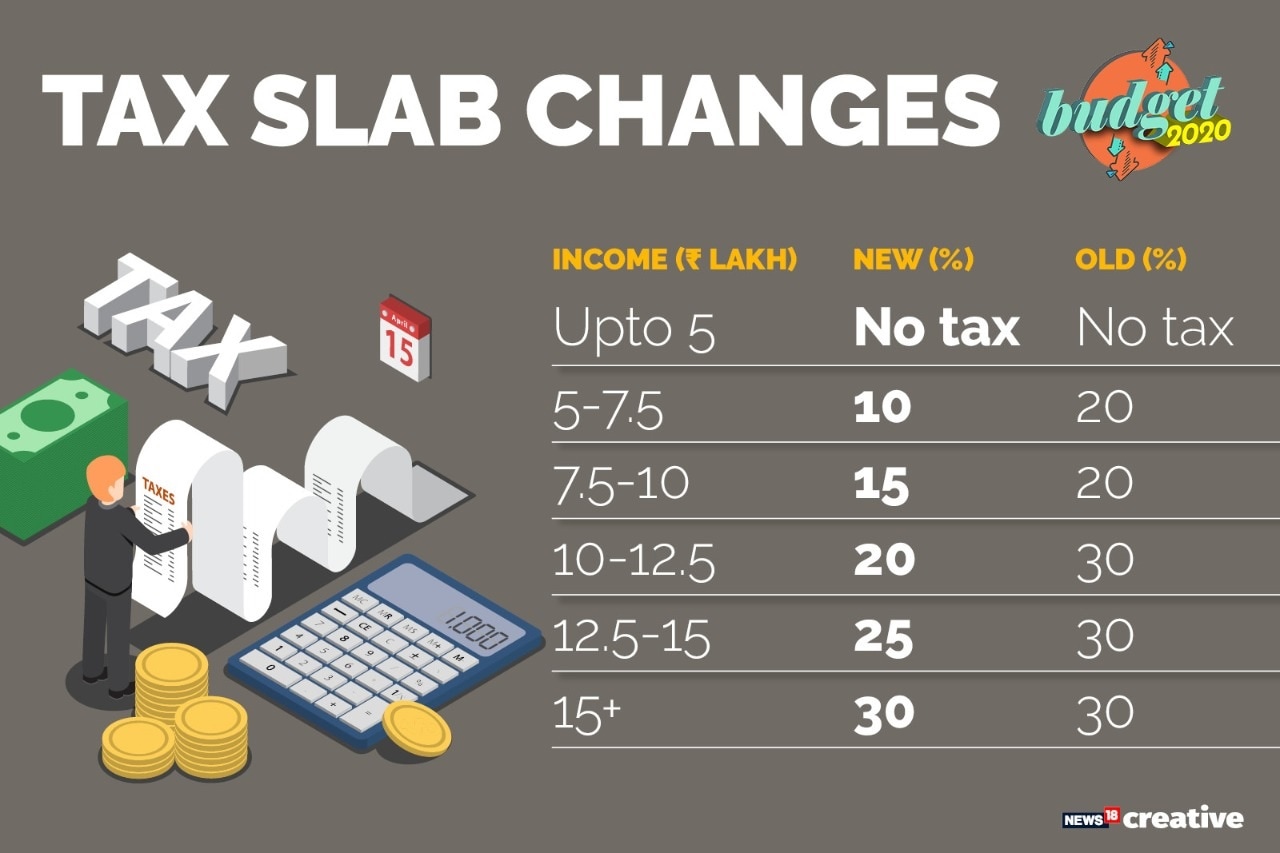

Opt new tax regime if deduction, exemption claims less than Rs 3.75, The latest budget for 2025 has introduced some significant changes to the income tax slabs in the new tax regime, aimed at making it more appealing to individual. Let's understand income tax calculation under the current tax slabs and new tax slabs.

Tax Slabs Comparison After Budget 2025 Taxes Under Old Regime, This calculator will work for both old and new tax slab rate which were released in 2025. The latest budget for 2025 has introduced some significant changes to the income tax slabs in the new tax regime, aimed at making it more appealing to individual.

How to choose between the new and old tax regimes Chandan, The tax slab under the new tax regime has been reduced from 6 to 5, and the basic exemption. 2) tax rebate under section 87a increased from rs 5 lakh to rs 7 lakh.

Deductions Under The New Tax Regime Budget 2025 Quicko Blog, To achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2025. For income upto rs 7.

तुम्हाला किती कर द्यावा लागेल? Tax Calculator वापरून काढा कराची रक्कम, Budget 2025 also proposed some changes in the income tax slabs. Chargeable income in excess of $500,000 up to $1.

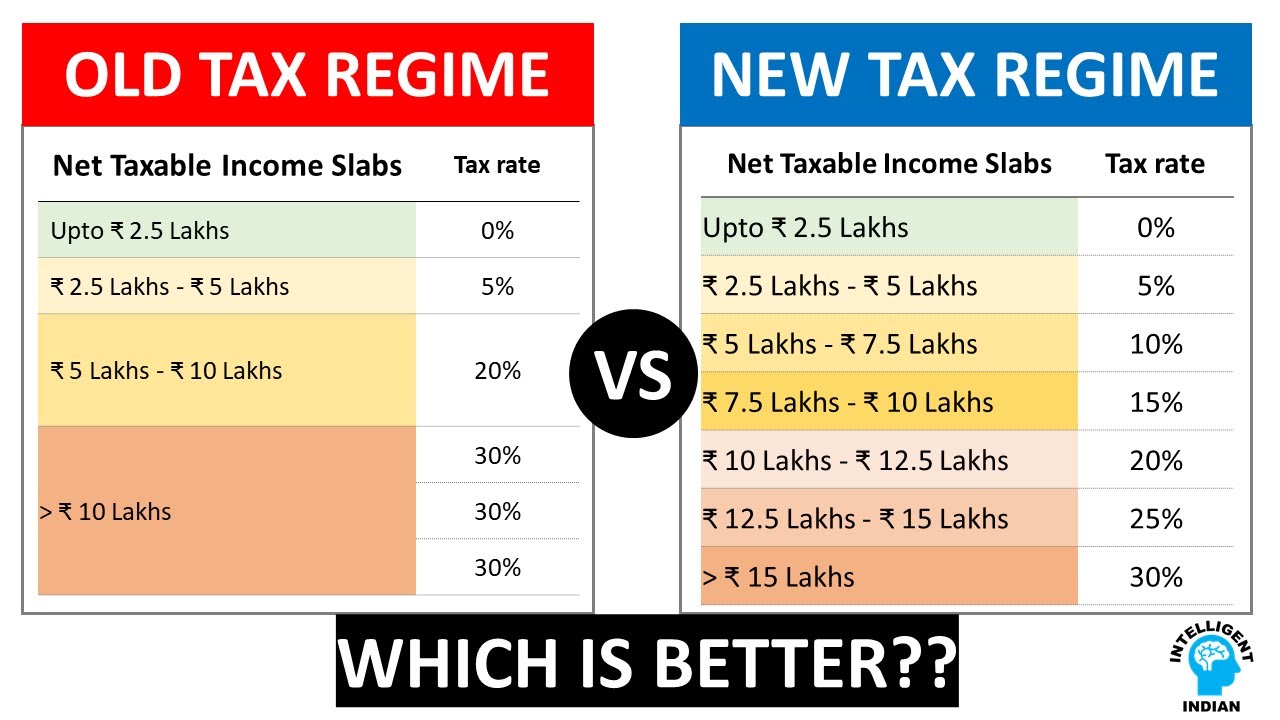

New Tax Regime Vs Old Tax Regime How To Choose The Better Option For, 2) tax rebate under section 87a increased from rs 5 lakh to rs 7 lakh. Let's understand income tax calculation under the current tax slabs and new tax slabs.

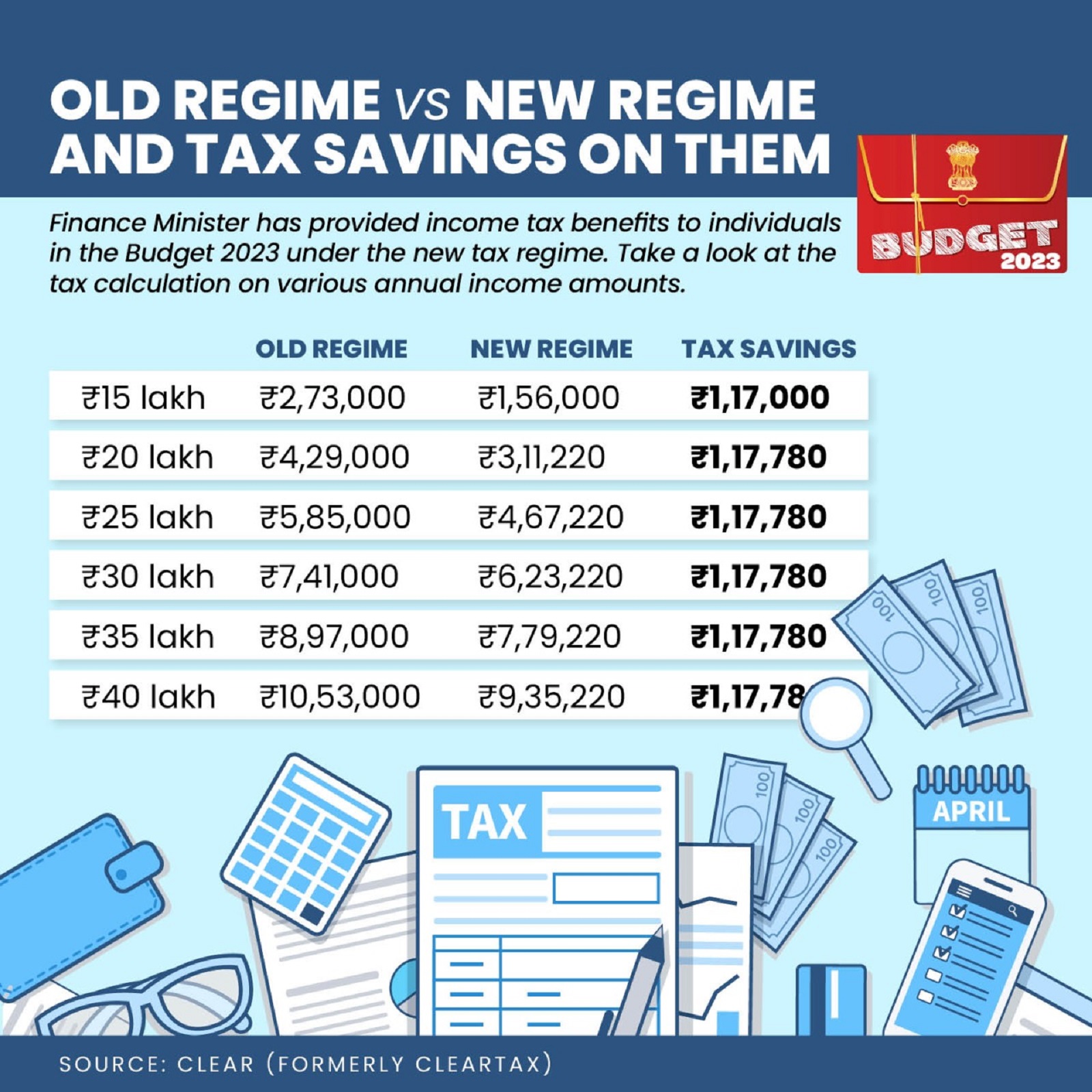

Budget 2025 Tax Slabs Savings Explained New tax regime vs Old, This year, interim union budget for the fiscal year 2025. Budget 2025 also proposed some changes in the income tax slabs.

Old vs New Tax Regime Slab Rates FY 202324 FinCalC Blog, Calculate your tax liability with new regime tax calculator, know how much tax you will have to. The union budget for fy24.

Tax Calculator New Regime 2025 24 Excel Printable Forms Free, To achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2025. Chargeable income in excess of $500,000 up to $1.

PeopleSoft Global Payroll for India 9.1 New Tax Regime, As you can see, the. The marginal tax relief in the new tax regime helps those whose income marginally exceeds rs 7.5 lakh pay much less in tax.

The income tax slab for fy 2025 under either the new or old tax system is an option for super senior people, just as for other individual taxpayers.