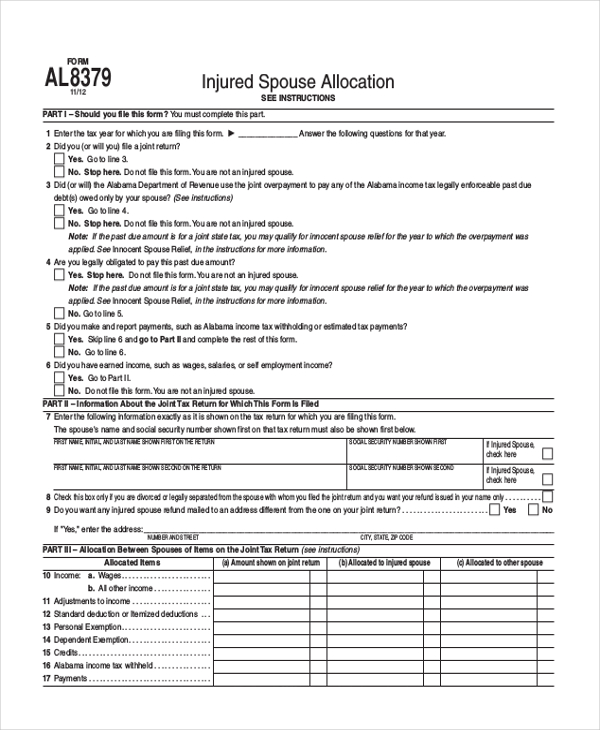

Injured Spouse Form 2025. The irs has a program in place for spouses who may face this unexpected challenge. Injured spouse relief can help you reclaim your share of a federal tax refund that was.

Irs form 8379 serves as a crucial instrument, enabling the injured spouse in a joint tax return to reclaim their rightful portion of a refund that was seized to address the other. Request innocent spouse relief as soon as you learn of the taxes due.

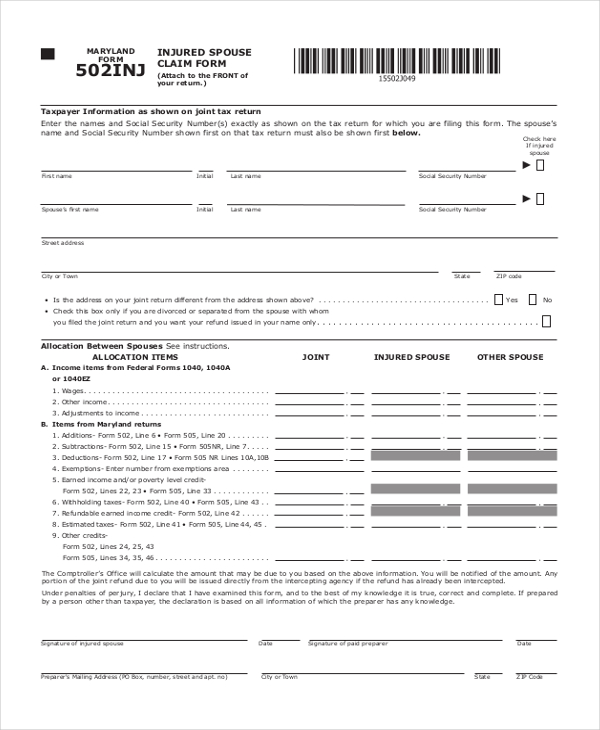

FREE 7+ Sample Injured Spouse Forms in PDF, Injured spouse relief is a provision established by the irs to address situations where a jointly filed tax refund is subject to offset to satisfy the debts of one spouse.

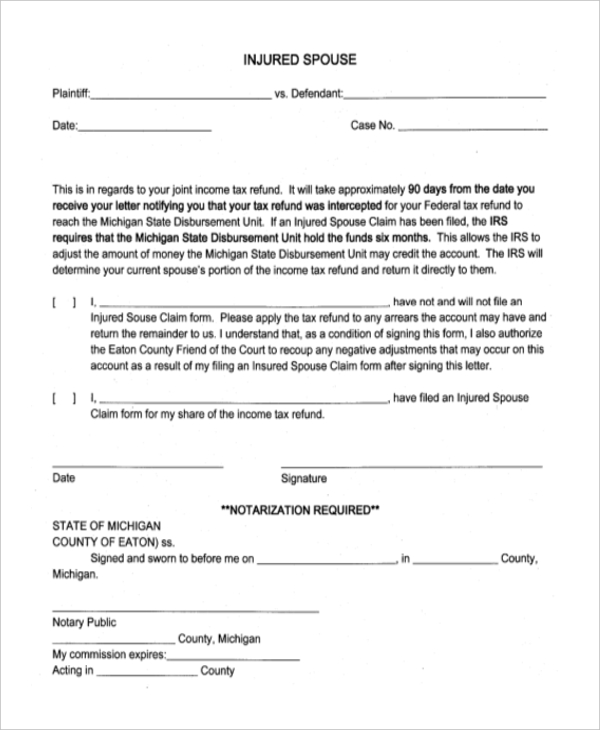

FREE 9+ Sample Injured Spouse Forms in PDF, Request innocent spouse relief as soon as you learn of the taxes due.

FREE 9+ Sample Injured Spouse Forms in PDF, Injured spouse relief is a provision established by the irs to address situations where a jointly filed tax refund is subject to offset to satisfy the debts of one spouse.

FREE 7+ Sample Injured Spouse Forms in PDF, Relief must generally be requested within three years of.

FREE 9+ Sample Injured Spouse Forms in PDF, The process for applying for innocent spouse relief involves filling out irs form 8857, request for innocent spouse relief. this form should not be filed with your tax return,.

FREE 9+ Sample Injured Spouse Forms in PDF, Innocent spouses are people who find themselves facing back taxes,.

FREE 9+ Sample Injured Spouse Forms in PDF, Request innocent spouse relief as soon as you learn of the taxes due.