Fsa Total For 2025. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care. The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025.

The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025. The irs confirmed that for plan years beginning on or after jan.

This handy fsa calculator will help you estimate your health spending for the year so you can make an informed decision and.

The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care.

Irs List Of Fsa Eligible Expenses 2025 Rorie Claresta, What is the new fsa contribution limit in 2025? Fsa participants can now contribute up to $3,200 through payroll deductions during the 2025 plan year.

Can Both Spouses Have An Fsa 2025 Tarah Francene, The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

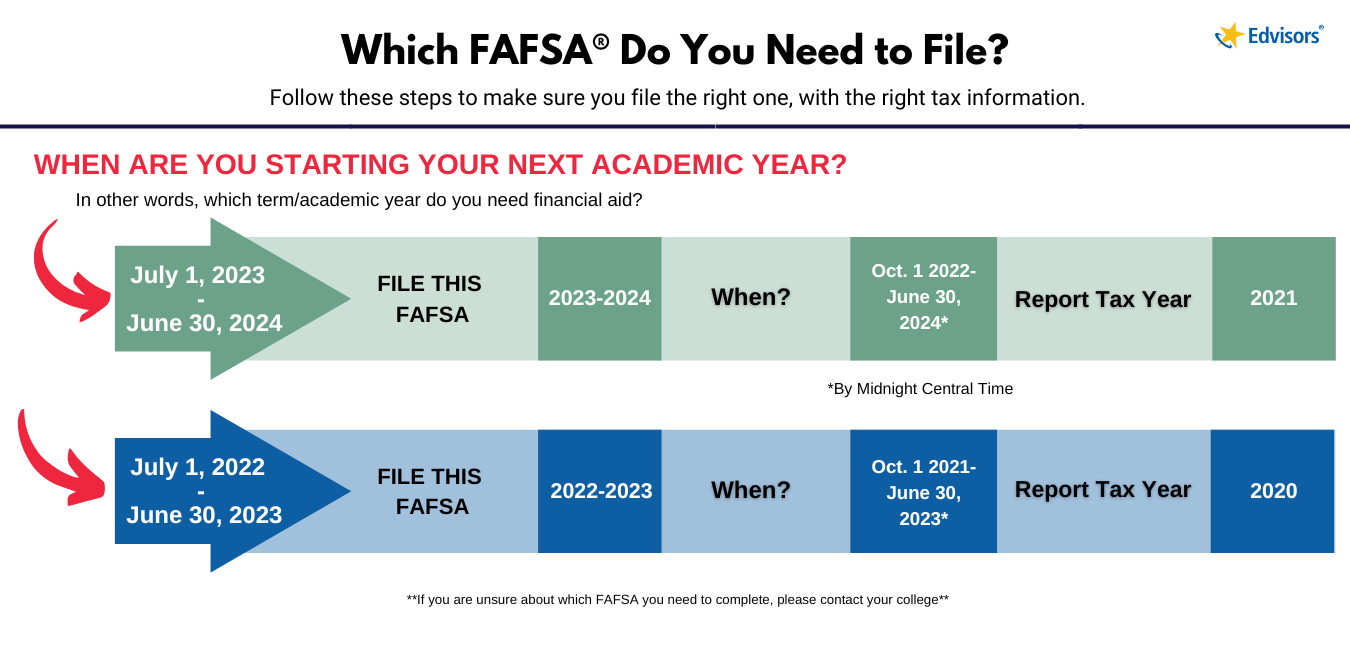

Fafsa Form For 2025 2025 Printable Forms Free Online, This handy fsa calculator will help you estimate your health spending for the year so you can make an informed decision and. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care.

S3Ep1 2025 FSA Limits M3 Insurance, What is the new fsa contribution limit in 2025? This chapter explains the rules for crediting federal student aid (fsa) funds to the student’s account and making direct disbursements to the student or parent, as well as.

Is A High Deductible Health Plan Worth It To Get An FSA?, 1, 2025, the contribution limit for health fsas will increase another $150 to $3,200. For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500.

New 2025 FSA and HSA limits What HR needs to know HRMorning, The cost of attendance (coa) is the cornerstone of establishing a student’s financial need, as it sets a limit on the total aid that a student may receive for purposes. For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500.

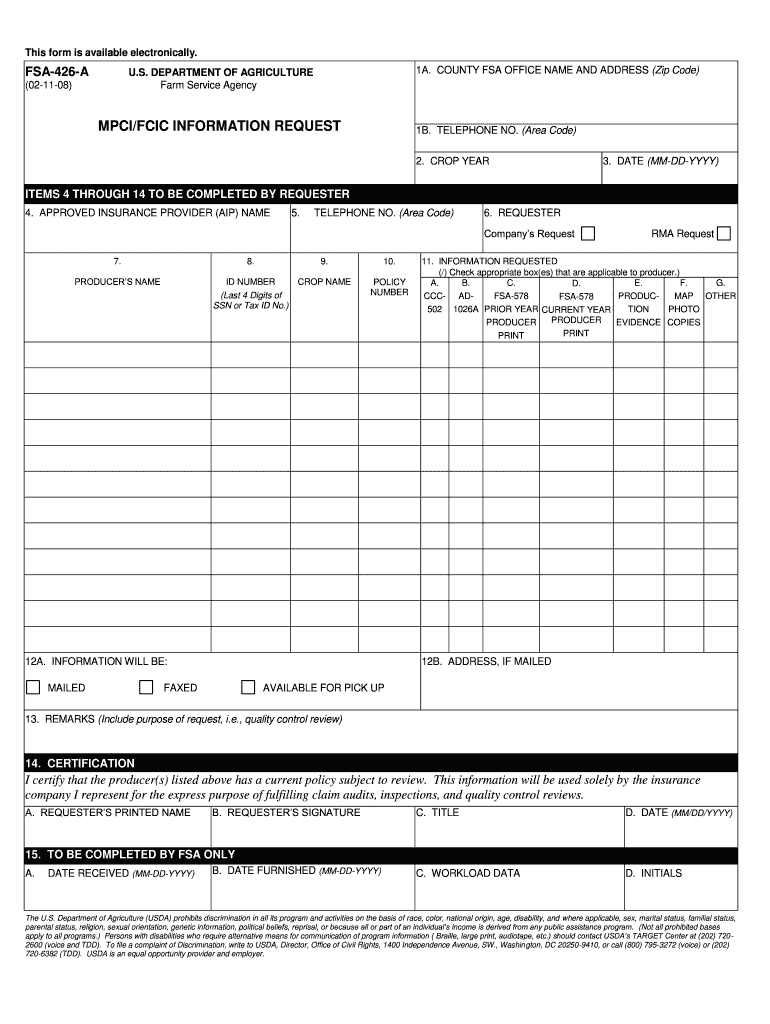

Fsa form Fill out & sign online DocHub, The adjustment for 2025 represents a $150 increase to the current $3,050 health fsa salary reduction contribution limit in 2025. Here’s what you need to know about new contribution limits compared to last year.

Health FSA Limit Increased for 2025, In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050). What is the new fsa contribution limit in 2025?

![How FSAs Work and What They Cover [2025] FinanceBuzz](https://images.financebuzz.com/2304x1215/filters:quality(75)/images/2021/01/28/fsa-account.jpeg)

2025 Health FSA Limit Increased to 3,200, Some employees may be able to eliminate more taxes next year and save more money because the irs has announced new increased contribution limits to. The irs establishes the maximum fsa contribution limit each year based on inflation.

How FSAs Work and What They Cover [2025] FinanceBuzz, The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in the table below. This chapter explains the rules for crediting federal student aid (fsa) funds to the student’s account and making direct disbursements to the student or parent, as well as.

The adjustment for 2025 represents a $150 increase to the current $3,050 health fsa salary reduction contribution limit in 2025.